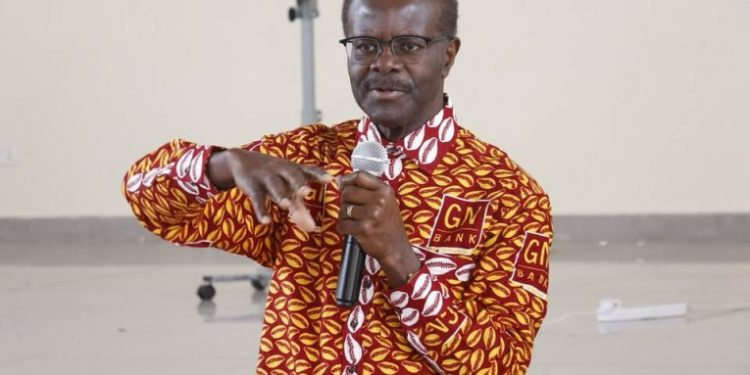

Dr Kwesi Nduom, the owner of the defunct GN Bank, has made a heartfelt plea to Dr Ernest Addison, the Governor of the Bank of Ghana (BoG), to pay attention to the new facts and reinstate his banking licence and restore his assets, which were revoked due to the bank’s insolvency.

Dr Nduom in his appeal urged the BoG Governor to preserve the assets of GN Bank in good condition, as they are ready to resume operations, implying that the bank’s assets are still viable and could be revitalised if its licence is reinstated.

In 2018, the Bank of Ghana (BoG) took measures to consolidate the banking sector, resulting in the revocation of licences from several financial institutions, including GN Bank.

The Bank of Ghana (BOG) on June 14, justified its decision to revoke the licence of GN Bank in 2019 insisting that the action was warranted due to significant regulatory breaches.

The Central Bank maintained that GN Bank failed to comply with critical financial regulations and banking standards which threatened its operational stability. Referring to a statement issued in August 2019 detailing reasons for the revocation, the Central Bank said, GN Bank fell short of capital adequacy, liquidity and governance and risk management requirements.

In a Facebook post on Sunday, June 23, Dr. Paa Kwesi Nduom vehemently disputed the Bank of Ghana’s (BoG) assertion that GN Bank lacked sufficient capital adequacy.

He implored Dr. Ernest Addison, the BoG Governor, to reexamine the evidence presented in the 2019 GN Savings and Loans transition report, which reveals that the bank had sufficient funds in its accounts, contrary to the BoG’s claims.

“So, when people ask what do you what? All that we’re saying is that recognise that indeed there was more money there, than was said to be just proof. Recognise the proof. Someone has said somewhere that give me new facts and I will change my mind. We have given and continue to give new facts to the BoG.

“All that we’re asking the Governor, Dr. Addison is to take a look at the new facts, recognise them for what they are and give us back our licence, give us back our assets. Make sure the assets are in good condition, and let’s move on.

“Even in the reclassifying state as a savings and loans company, we are prepared to start working. And we know once all the accounting is done, once the funds start coming in, everybody will realise that the 305-branch network of GN Savings will deserve to become a universal bank-GN Bank again. That is it.”

He envisaged to employ thousands of people when their licences were given back to them.

“What we are looking for is to go back and put thousands of people back to work and 100s of branches, so that financial inclusion can resume.”

“For a savings and loans company, what you need is GHC15 million, that’s all. Even the GHC30.3 million that the finance ministry erroneously told the BoG, that Group Nduom companies had, Even if we took that money, and paid it, which still they haven’t paid. If they paid us and we paid into GN Savings, That would have been able to give us the capital required to continue on our savings and loans. But we said in our books, GHC2 million.

“In addition, we had properties and other related buildings including the many branch buildings put up by some of our companies. We said we would give it to the organisation to shore its capital.

“It was all rejected, and these are the same buildings that BoG’s appointed receiver went around hurriedly to put locks in the gates and buildings and walked away. Left them to rot, all of those things still there.”