The Bank of Ghana (BoG) is strengthening its reserves to address the depreciation of the cedi against major foreign currencies, anticipating increased demand for foreign exchange with the festive season approaching.

This initiative aims to provide reassurance to businesses and consumers, promoting greater stability for the local currency amid ongoing pressures.

Currently, the cedi is trading at nearly GHS 17 to the dollar, reflecting a year-to-date depreciation of 24.3%.

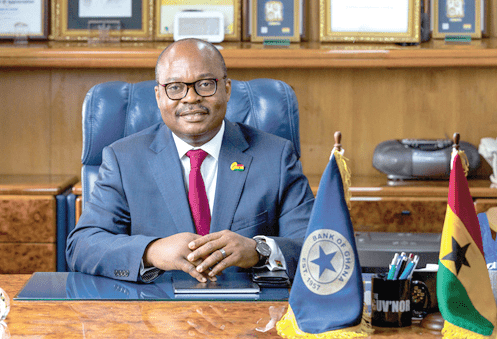

Dr. Ernest Addison, Governor of the Bank of Ghana, stressed the importance of bolstering reserves to mitigate fluctuations in the cedi’s value and ensure economic stability.

“Some are hoping the cedi will rebound to GHS 10.00 to the dollar, but we must recognize the complexities of our economy, including exchange rate issues and challenges in the financial sector. The good news is that we are making progress, and our situation mirrors that of other countries facing similar challenges.

“We need to remain focused, implement sound policies, and build reserves to support the progress we’ve achieved,” he explained.

This strategy not only aims to strengthen the cedi but also to enhance investor confidence and contribute to overall economic stability.

“We currently hold $7 billion in foreign exchange reserves. While I could influence the dollar-cedi rate to GHS 10 tomorrow, the real question is what happens the following day. Therefore, we are carefully balancing various factors as we build reserves and manage the exchange rate. There is still hope for improvement,” Governor Addison added.

He made these remarks during the launch of “The Concise Law of Banking,” a new book by legal practitioner Afua Appiah-Adu.

This practical guide to banking law, commissioned by the Institute for Law & Development (ILAD), is designed for students, banking professionals, lawyers, and others interested in understanding banking law principles.

The book comprehensively covers essential topics, including:

- Introduction to Banking Law

- Bank Regulation, Supervision, and Licensing

- The Banker-Customer Relationship

- Bank Accounts

- Cheques

- Recovery of Money Paid Mistakenly

- Paying Bank and Collecting Bank

- Electronic Payment Systems

- Payment Cards

- Offshore Banking

- Credit Reporting

- Borrowing and Lending in Banking

- Documentary Credits

- Money Laundering

It serves as a valuable resource for anyone seeking to navigate the complexities of banking law.